Are you tired of managing your business finances with outdated spreadsheets and manual processes? Are you struggling to gain a clear understanding of your company’s financial health? If so, then it’s time to consider implementing an Enterprise Resource Planning (ERP) system. ERP software can revolutionize your financial management by automating key processes, providing real-time visibility into your financials, and offering powerful analytics capabilities. This article will explore how ERP software can improve your financial management, from budgeting and forecasting to accounts payable and receivable.

What is ERP Software?

Enterprise Resource Planning (ERP) software is a suite of integrated applications that an organization can use to collect, store, manage, and interpret data from different business activities. ERP systems provide a centralized view of all your business operations, giving you the information you need to make better decisions.

How does ERP software work?

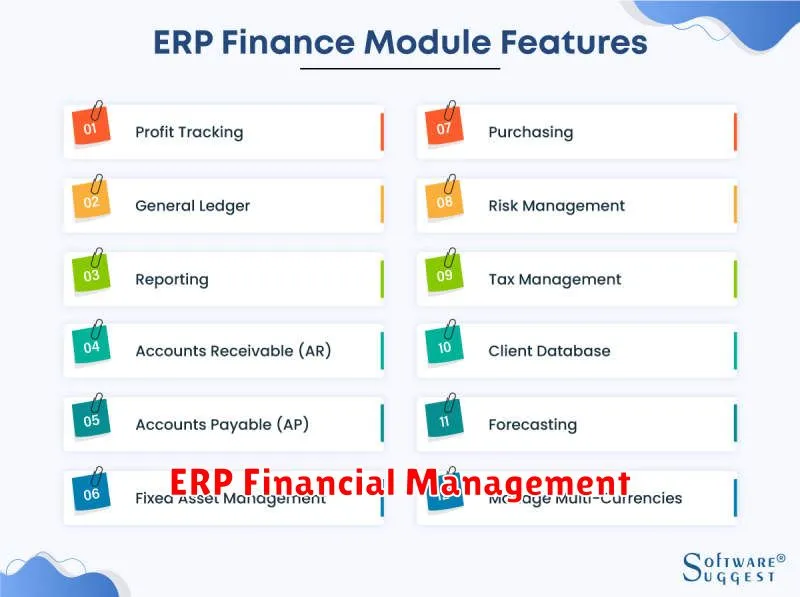

ERP software typically consists of several modules that handle specific business functions, such as:

- Finance: Accounts payable, accounts receivable, general ledger, budgeting, financial reporting

- Human Resources: Payroll, benefits, recruiting, training, employee records

- Supply Chain Management: Purchasing, inventory, warehousing, distribution, manufacturing

- Sales and Marketing: Customer relationship management (CRM), order management, marketing automation

- Production: Planning, scheduling, quality control, maintenance

These modules are all connected, so data can be shared across the system. This allows businesses to automate processes, improve efficiency, and make more informed decisions.

Benefits of using ERP software

There are many benefits to using ERP software, including:

- Improved efficiency: Automating processes and reducing manual tasks can save time and resources.

- Better decision-making: Having a single, centralized view of all business operations can provide better insights for decision-making.

- Enhanced collaboration: ERP systems can improve communication and collaboration between different departments.

- Increased profitability: By streamlining processes and improving efficiency, ERP can help businesses increase profitability.

- Reduced costs: ERP can help businesses save money by automating tasks, reducing manual errors, and eliminating waste.

- Improved customer service: ERP can help businesses provide better customer service by giving them a better understanding of their customers’ needs.

- Increased compliance: ERP systems can help businesses meet regulatory requirements.

Choosing the right ERP software

Choosing the right ERP software is important for businesses of all sizes. When selecting an ERP system, you should consider the following factors:

- Your business needs: What are your key business processes? What challenges are you facing? What are your goals for using ERP software?

- Your budget: ERP software can range in price from a few thousand dollars to millions of dollars. It’s important to consider what you can afford.

- Your industry: Some ERP systems are designed specifically for certain industries. Make sure to choose a system that’s appropriate for your industry.

- Your company size: The size of your company will affect your ERP software needs. Small businesses may need a simpler system than large enterprises.

- Scalability: Choose an ERP system that can grow with your business.

- Implementation costs: Implementing ERP software can be expensive. Be sure to factor in the cost of implementation when making your decision.

Conclusion

ERP software can be a valuable tool for businesses of all sizes. By automating processes, improving efficiency, and providing a centralized view of business operations, ERP can help businesses achieve their goals and grow.

Core Financial Modules in ERP Systems

Enterprise Resource Planning (ERP) systems are comprehensive software solutions designed to integrate and manage various business processes. Among the core modules, financial modules play a pivotal role in streamlining financial operations, providing real-time insights, and enabling informed decision-making. This article delves into the essential financial modules commonly found in ERP systems.

General Ledger (GL)

The General Ledger module serves as the central repository for financial transactions, recording all financial activities within an organization. It provides a comprehensive view of the company’s financial position, including assets, liabilities, equity, revenue, and expenses. The GL module facilitates the creation of financial statements, such as the balance sheet, income statement, and cash flow statement, for internal and external reporting purposes.

Accounts Payable (AP)

The Accounts Payable module manages the process of paying suppliers and vendors for goods and services received. It tracks invoices, payment terms, and due dates, ensuring timely payments and minimizing late fees. The AP module streamlines the invoice approval workflow, reducing manual processes and improving efficiency. It also integrates with the GL module, automatically updating the ledger with payment transactions.

Accounts Receivable (AR)

The Accounts Receivable module focuses on managing customer invoices and collections. It tracks outstanding invoices, payment histories, and credit limits, providing a clear picture of customer receivables. The AR module automates the invoicing process, reduces manual errors, and streamlines the collection efforts, improving cash flow and customer satisfaction.

Fixed Assets

The Fixed Assets module manages the lifecycle of long-term assets, such as equipment, buildings, and vehicles. It tracks asset acquisitions, depreciation, maintenance, and disposal, ensuring compliance with tax regulations and providing valuable insights into asset performance. The Fixed Assets module helps optimize asset utilization, minimize downtime, and enhance financial reporting accuracy.

Budgeting and Forecasting

The Budgeting and Forecasting module empowers organizations to plan and manage their financial resources effectively. It allows users to create budgets, track actual expenses, and analyze variances, enabling proactive financial management. The module also facilitates scenario planning, allowing businesses to explore different financial outcomes under various conditions.

Financial Reporting and Analysis

The Financial Reporting and Analysis module provides robust tools for generating financial reports and performing in-depth analysis. It offers customizable report templates, allowing businesses to generate customized reports tailored to specific needs. The module also facilitates data visualization, enabling users to gain insights from financial data through graphs, charts, and dashboards.

Conclusion

Core financial modules in ERP systems play a critical role in optimizing financial operations, improving efficiency, and driving informed decision-making. By integrating these modules, organizations can achieve greater financial transparency, control, and agility, enabling them to thrive in a competitive business environment.

Automating Financial Processes

In today’s fast-paced business environment, efficiency is paramount. Companies are constantly looking for ways to streamline their operations and reduce costs, and financial processes are no exception. Automation has emerged as a powerful tool for achieving these goals, transforming the way businesses manage their finances.

The Benefits of Financial Automation

Automating financial processes offers numerous advantages, including:

- Increased Efficiency: Automation eliminates manual tasks, freeing up employees to focus on more strategic initiatives.

- Reduced Errors: Automation minimizes the risk of human error, leading to more accurate financial data.

- Improved Compliance: Automated systems can help ensure compliance with regulatory requirements.

- Faster Processing Speeds: Automation speeds up processes, such as invoice processing and payroll, leading to faster payments and improved cash flow.

- Enhanced Visibility: Automated systems provide real-time insights into financial performance, allowing for better decision-making.

Types of Financial Processes that Can Be Automated

Many financial processes can be automated, including:

- Invoice Processing: Automated invoice processing systems can capture, extract, and process invoices automatically.

- Expense Management: Automated expense management tools streamline the expense reporting process and track employee spending.

- Payroll: Automated payroll systems calculate and process payroll payments, ensuring accurate and timely payments.

- Reconciliation: Automated reconciliation systems match bank statements with transactions, reducing the time and effort required for manual reconciliation.

- Financial Reporting: Automated reporting tools generate financial reports and dashboards, providing key performance indicators (KPIs) and insights into financial health.

Choosing the Right Automation Solutions

The specific automation solutions that are right for your business will depend on your unique needs and requirements. Consider factors such as:

- The complexity of your financial processes

- The volume of transactions

- Your budget

- Your current technology infrastructure

It’s important to carefully evaluate different solutions and choose those that will provide the greatest benefits for your business.

Conclusion

Financial automation is transforming the way businesses manage their finances, offering significant benefits in terms of efficiency, accuracy, and compliance. By embracing automation, companies can unlock new levels of financial performance and gain a competitive edge in today’s dynamic market.

Improving Financial Reporting and Analysis

In today’s fast-paced business environment, it is more important than ever for companies to have accurate and timely financial reporting and analysis. This information is essential for making sound business decisions, attracting investors, and ensuring the company’s long-term sustainability. However, many companies struggle to produce high-quality financial reports, leading to inaccurate insights and potentially costly mistakes.

To improve financial reporting and analysis, companies should focus on the following key areas:

1. Data Accuracy and Integrity:

The foundation of any effective financial reporting system is accurate and reliable data. This means implementing robust internal controls to ensure that data is captured, processed, and reported accurately. Companies should also invest in data quality management tools and processes to identify and correct data errors before they impact reporting.

2. Standardization and Consistency:

Using a standardized approach to financial reporting ensures consistency across different departments and reporting periods. This reduces the risk of errors and makes it easier to track financial performance over time. Companies should adopt accounting standards and reporting frameworks such as GAAP or IFRS, and ensure that all employees involved in financial reporting are properly trained and understand these standards.

3. Technology and Automation:

Modern financial reporting technology can streamline and automate many manual processes, reducing the risk of errors and improving efficiency. Companies should explore solutions such as cloud-based accounting software, data analytics tools, and automated reporting systems. These technologies can also provide valuable insights that would be difficult to obtain manually.

4. Real-time Reporting and Dashboards:

Traditional financial reporting often involves a delay between the end of a reporting period and the availability of information. However, in today’s data-driven environment, businesses need real-time insights to make quick decisions. Companies should adopt real-time reporting tools and dashboards that allow executives and stakeholders to access up-to-date financial information. This will enhance their ability to track performance, identify trends, and respond quickly to market changes.

5. Collaboration and Communication:

Effective financial reporting involves the collaboration of different departments, such as finance, operations, and sales. Strong communication channels are essential to ensure that all stakeholders have access to the information they need and that everyone is aligned on key performance indicators. Companies should foster a culture of transparency and collaboration to improve communication and the quality of financial reporting.

By focusing on these key areas, companies can significantly improve the quality and effectiveness of their financial reporting and analysis. This will lead to better business decisions, increased investor confidence, and ultimately, a more sustainable future for the organization.

Enhancing Data Accuracy and Security

In today’s data-driven world, the accuracy and security of data are paramount. Organizations rely heavily on data for critical decision-making, operations, and customer interactions. However, ensuring the integrity and protection of this valuable asset can be challenging. This article will delve into key strategies for enhancing data accuracy and security, empowering organizations to leverage their data effectively while mitigating risks.

Data Accuracy is the foundation of any successful data-driven initiative. Inaccurate data can lead to flawed analyses, incorrect decisions, and ultimately, negative business outcomes. To improve data accuracy, organizations can implement the following measures:

- Data Cleansing: Regularly identify and remove duplicates, inconsistencies, and errors from data sources. Automated data cleansing tools can streamline this process.

- Data Validation: Implement data validation rules to ensure that data conforms to defined standards and business constraints. This helps prevent invalid or incorrect data from entering the system.

- Data Governance: Establish clear data governance policies and procedures to define data ownership, access rights, and data quality standards. This fosters accountability and promotes data accuracy across the organization.

Data Security is equally crucial to protect sensitive information from unauthorized access, use, disclosure, disruption, modification, or destruction. Implementing robust security measures is essential to safeguard data and maintain trust with stakeholders.

- Access Control: Implement strong access control mechanisms to restrict access to data based on user roles and permissions. This helps prevent unauthorized individuals from accessing sensitive information.

- Encryption: Encrypt data at rest and in transit to protect it from interception and unauthorized access. Encryption technologies scramble data, making it unreadable without the appropriate decryption key.

- Security Awareness Training: Educate employees about data security best practices, such as strong password creation, phishing awareness, and data handling protocols. This helps minimize the risk of human error and malicious activities.

By prioritizing data accuracy and security, organizations can reap the benefits of their data while mitigating potential risks. These strategies contribute to a data-driven culture that fosters trust, enables informed decision-making, and ultimately drives business success.

Real-Time Financial Visibility and Decision-Making

In today’s rapidly evolving business landscape, having real-time financial visibility is no longer a luxury but a necessity. Businesses that can access and analyze financial data in real-time have a significant advantage in making informed decisions, optimizing operations, and staying ahead of the competition.

Traditional financial reporting methods often involve delays, making it difficult for businesses to react quickly to changes in the market. However, with the advent of advanced technologies like cloud computing, artificial intelligence, and data analytics, real-time financial visibility has become more accessible than ever before.

Benefits of Real-Time Financial Visibility

Real-time financial visibility offers a wide range of benefits for businesses, including:

- Improved Decision-Making: With real-time insights, businesses can make data-driven decisions based on the latest financial information, leading to better resource allocation, cost optimization, and risk mitigation.

- Enhanced Operational Efficiency: By monitoring key financial metrics in real-time, businesses can identify bottlenecks, optimize workflows, and improve overall operational efficiency.

- Increased Profitability: Real-time financial insights allow businesses to identify revenue opportunities, reduce costs, and optimize pricing strategies, ultimately leading to increased profitability.

- Early Detection of Risks: Proactive monitoring of financial data helps businesses detect potential risks early on, allowing them to take corrective measures before they escalate into major problems.

- Improved Customer Service: Real-time financial visibility enables businesses to better understand customer spending patterns and provide personalized services tailored to their needs.

Key Components of Real-Time Financial Visibility

To achieve true real-time financial visibility, businesses need to implement a comprehensive system that includes:

- Data Integration: Consolidating financial data from various sources, including accounting systems, CRM, and e-commerce platforms, is essential for a holistic view.

- Automated Reporting: Automating the generation of financial reports eliminates manual effort and ensures timely delivery of data.

- Interactive Dashboards: User-friendly dashboards that visualize key financial metrics in real-time allow stakeholders to quickly grasp the financial health of the business.

- Predictive Analytics: Using AI and machine learning algorithms to forecast future financial trends and identify potential risks and opportunities.

Conclusion

In today’s dynamic business environment, real-time financial visibility is no longer a nice-to-have but a must-have for businesses looking to thrive. By embracing advanced technologies and implementing a comprehensive system, businesses can unlock the power of real-time financial insights and gain a competitive edge.

Case Studies: ERP’s Impact on Financial Management

Enterprise Resource Planning (ERP) systems have become ubiquitous in modern businesses, revolutionizing the way organizations manage their operations. This comprehensive software suite integrates various business processes, including financial management, human resources, supply chain, and customer relationship management, into a unified platform. Implementing an ERP system can bring significant benefits to a company’s financial health, streamlining processes, enhancing visibility, and driving efficiency.

This article will explore the impact of ERP systems on financial management through real-world case studies, showcasing how organizations have leveraged these solutions to achieve tangible results. We will delve into key areas such as:

- Improved financial reporting and analysis

- Enhanced budgeting and forecasting accuracy

- Streamlined accounts payable and receivable processes

- Reduced operational costs

- Increased financial transparency and control

Case Study 1: Manufacturing Giant Streamlines Financial Operations

A large manufacturing company faced challenges with manual processes, fragmented data, and inefficient reporting. They implemented an ERP system that integrated their financial processes, including accounting, budgeting, and inventory management. This resulted in:

- Real-time visibility into financial performance, allowing for proactive decision-making.

- Automated reporting, eliminating manual data entry and reducing errors.

- Improved forecasting accuracy, leading to better resource allocation and profitability.

Case Study 2: Retail Chain Optimizes Cash Flow

A retail chain struggled with managing cash flow and reconciling transactions across multiple locations. By deploying an ERP system, they achieved:

- Centralized cash management, providing a single view of cash balances and transactions.

- Automated reconciliation, reducing manual effort and improving accuracy.

- Optimized inventory management, minimizing stockouts and excess inventory.

Case Study 3: Non-Profit Organization Enhances Transparency

A non-profit organization sought to improve financial transparency and accountability. They implemented an ERP system to manage donations, grants, and expenses. This led to:

- Real-time donor tracking, enabling personalized communications and engagement.

- Automated grant management, simplifying reporting and compliance requirements.

- Enhanced financial transparency, building trust with donors and stakeholders.

Conclusion

The case studies demonstrate the transformative power of ERP systems in financial management. By automating processes, enhancing visibility, and providing real-time insights, these solutions enable organizations to optimize financial performance, drive efficiency, and achieve strategic objectives. As businesses continue to adopt innovative technologies, ERP systems will play a crucial role in empowering financial professionals to navigate the evolving landscape of finance.